Prior to the coronavirus outbreak, Elizabeth Barber, 59, was barely squeaking by. While earning $12.89 per hour as a home health aide near Rochester, New York, she defaulted on her federal student loans last year and received a notice in December that the Department of Education would begin wage garnishment.

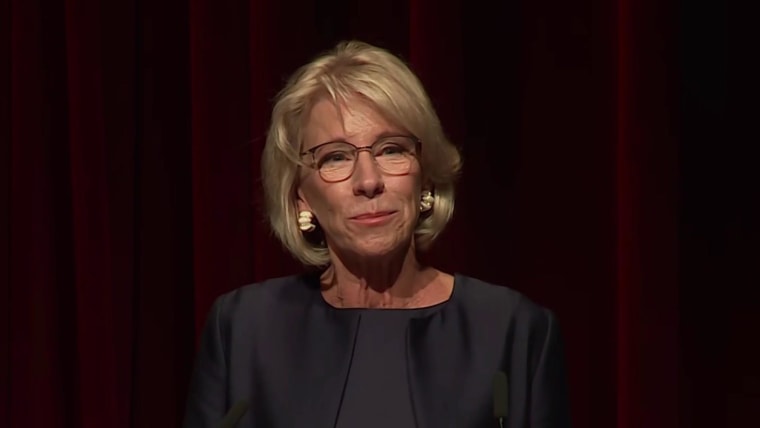

Then, in late March, Education Secretary Betsy DeVos announced a reprieve for student borrowers such as Barber that includes the federal government temporarily halting collection actions, effective through the end of September.

Full coverage of the coronavirus outbreak

“These are difficult times for many Americans, and we don’t want to do anything that will make it harder for them to make ends meet or create additional stress,” DeVos said at the time.

But Barber says she has seen no such relief — and student borrower advocates believe the Department of Education has been similarly failing scores of students across the country.

A lawsuit filed Thursday in U.S. District Court in Washington by student borrower groups on behalf of Barber accuses DeVos and the Education Department of continuing to “seize wages from distressed federal student loan borrowers” during the pandemic.

Most recently, Barber had $70.20 taken out of her April 24 paycheck, according to the suit, on top of the more than $900 seized since the beginning of the year. She has seen her hours working with clients who have cerebral palsy get significantly scaled back in recent weeks. Meanwhile, she still owes $10,000 worth of student loans and has been unable to pay her electric and water bills.

Let our news meet your inbox. The news and stories that matters, delivered weekday mornings.

“I am so worried about how I will get through this,” Barber said.

Surveys have shown about half of Americans live paycheck to paycheck, and with the coronavirus pandemic ravaging the economy and tens of millions of Americans filing for unemployment, the financial strain is only expected to worsen.

“Right now, low-wage workers hit hardest by the economic impact of the pandemic need their paychecks to keep food on the table and a roof over their heads,” said Persis Yu, the director of the National Consumer Law Center’s Student Loan Borrower Assistance Project, which filed the lawsuit along with the National Student Legal Defense Network, a nonprofit law firm.

“By continuing to use its harsh collection tools during this public health and economic crisis, the Department of Education is placing the health, safety and well-being of vulnerable student loan borrowers in peril,” Yu added.

The exact number of student borrowers who are still having their wages garnished is unclear, but according to the lawsuit, the department estimated about 285,000 people had parts of their paycheck taken between March 13 and March 26 — just before DeVos’ action took effect.

The relief was granted as part of the Coronavirus Aid, Relief, and Economic Security Act, a $2 trillion stimulus package signed by President Donald Trump.

The law, however, doesn’t automatically stop the garnishing of wages if a student borrower is in default, rather employers must still enact the change to borrowers’ paychecks, which is done through a notification from the Education Department. The agency has been accused of dragging its feet. According to Barber’s lawsuit, her employer told her that it had not received any communication from the federal government instructing it to cease garnishment.

The lawsuit seeks to enforce that the Education Department abides by the CARES Act and that any illegally seized wages are refunded.

Angela Morabito, a spokeswoman for the department, said Friday that the agency does not comment on pending litigation, but that it has more broadly “taken immediate action to notify employers to stop garnishing wages.”

She added that the department’s default loan servicer has made attempts by phone, email and through letters to reach employers and that refunds are being given. “The Department relies on employers to stop garnishing wages, but is taking every measure to contact employers and refund garnished wages to borrowers until Sept. 30, 2020,” Morabito said in a statement.

Seth Frotman, executive director of the Student Borrower Protection Center, a consumer advocacy group supporting Barber’s lawsuit, said the confusion and distress put on student borrowers over the Education Department’s handling of student loan collections is not new.

Download the NBC News app for full coverage and alerts about the coronavirus outbreak

Last fall, a federal judge held DeVos in contempt of court for violating an order to stop collecting loans from thousands of former for-profit college students. The Education Department was fined $100,000. It said it was “disappointed” in the court’s ruling.

Frotman said student borrowers are often on the hook with fees and negative credit reports when they make a mistake or fall behind on their loan payments, but the Education Department isn’t held to that same standard when it drops the ball.

“It is outlandish that we needed to file a lawsuit to ensure the department doesn’t continue to seize the wages of the most vulnerable student loan borrowers in the middle of the worst economic crisis we’ve faced,” he added.