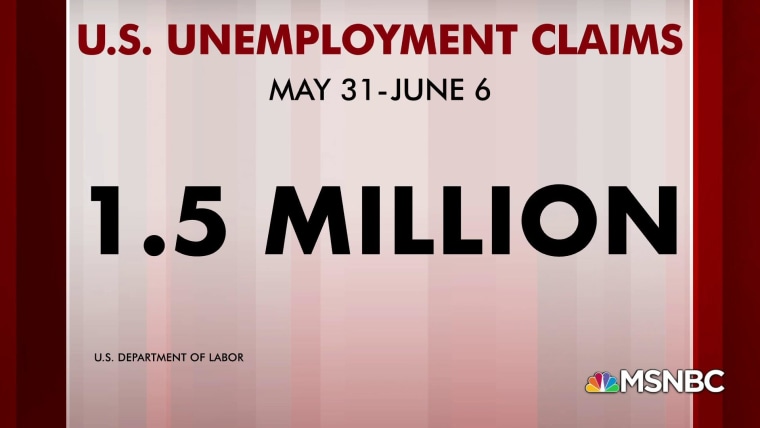

More than 1.5 million people filed for unemployment for the first time last week, according to data released Thursday by the Department of Labor.

The jobless claims add to a devastating run of economic data that has shown the number of Americans continuing to apply for unemployment benefits jump to 20 million in the last four months, as coronavirus shutdowns have pushed businesses to furlough or lay off workers.

But the pace of jobless claims continues to decline, with Thursday’s data adding to the trend. The claims came slightly below economists’ expectations of 1.6 million first-time jobless claims and is a third of the peak of claims from early April.

Even as the number of Americans seeking state or federal unemployment benefits for the first time has fallen for 10 straight weeks, it is still historically high. In the months before the coronavirus pandemic hit, jobless claims hovered around 210,000.

Continuing claims, which are people collecting unemployment benefits for at least two weeks, provided a bright spot in the data, declining by 339,000, to 20.9 million.

“The decline in continuing claims was encouraging, signaling at least some people are returning to employment. States and businesses have reopened but activity remains restricted and subdued which will likely result in ongoing layoffs over coming weeks,” Rubeela Farooqi, chief U.S. economist for High Frequency Economics, a research firm, said in an email.

The country’s employment crisis now also faces growing fears of a second wave of coronavirus infections, with several states reporting an uptick in new cases.

U.S. stocks dropped sharply Thursday morning, with the Dow Jones Industrial Average falling about 760 points, or 2.8 percent, in morning trading. The S&P 500 declined 2.5 percent, and the Nasdaq fell 2.1 percent.

Last week, the government-reported overall unemployment rate unexpectedly fell to 13.7 percent in May. However, when corrected for a classification error, the rate more likely fell to near 16.4 percent.

The reported job gains last month drew heavily on retail, hospitality and travel industries, which did not have significant reopenings during the time, said Daniel Alpert, a managing partner at Westwood Capital and a senior fellow in financial macroeconomics at Cornell Law School.

But instead of being sent back to work, many of them were simply being “re-payrolled” under the Paycheck Protection Program, effectively swapping one type of government assistance for another. The program provides several weeks of payroll relief to coronavirus-impacted businesses that keep employees on payroll.

After the government funds run out, “How many of those jobs are going to come back in real life?” Alpert said.

Federal Reserve Chairman Jerome Powell echoed that sentiment, speaking on Wednesday after a monetary policymaking meeting. “There will be a significant chunk, well into the millions of people who don’t get to go back to their old jobs, and there may not be a job in that industry for them for some time,” he said.